My last update on Lakehead University’s finances was in October 2021 and at that time despite the pandemic, it was doing well according to its 2020-2021 financial statement. From 2020 to 2021, revenues did fall slightly from $200.2 million to $198.4 million – a drop of just under one percent. However, total expenses fell even faster going from $198.7 million in 2020 to $187.6 million in 2021 – a drop of 5.5 percent. As a result, there was an operating surplus of $10.691 million in 2021 which was up from a surplus of $1.542 million in 2020. And this was before the unrealized gains from an interest rate swap are factored in which brought the total surplus to $14.456 million. In the end, the sky did not fall during the pandemic. Moreover, there has been a long period of good financial performance given that over the 2000 to 2022 period, there have only been six deficits with the remaining years seeing surpluses – that is about 75 percent of the time.

We are now in summer of 2023 and while financial statements for 2021-22 are up and available, those for 2022-23 have yet to appear. However, this type of lag appears customary across Ontario universities as the 2022-23 statements do not seem to appear on other university sites yet either. Nevertheless, it is possible to quickly update the figures provided in October of 2021 with an additional year of data.

Figure 1 shows that for 2022, revenues were at $184.824 million, down by $13.6 million dollars while expenses were up $17,470 million reaching $205.227 million. As a result, the previous year’s surplus of $10.691 million had become a deficit of $20.403 million. If one factors in unrealized gains on interest rate swaps, then the deficit falls to $16.729 million. At first glance, it would appear that the end of COVID savings and the resumption of in person teaching was accompanied by both rising expenditures and falling revenues.

However, while general government grants from 2021 to 2022 fell from 64.014 million to $61.611 million, restricted grants rose from $16.838 to $22.005 million. As well, Student fees also rose from $84.460 million to $86.962 million while the sales of goods and services nearly doubled in value going from $6.621 million to $12.279 million. All in all, taken together, these should result in rising rather than falling revenues. However, the crucial variable here is the inclusion of investment income which was $20.055 million in 2021 (hence the large surplus that year) and -$5.384 million in 2022 (hence part of the 2022 deficit explanation). However, it should be noted that much of this deficit is due to investment performance and if the 2021 investment performance had replicated itself, one would have seen a balanced budget if not a small surplus.

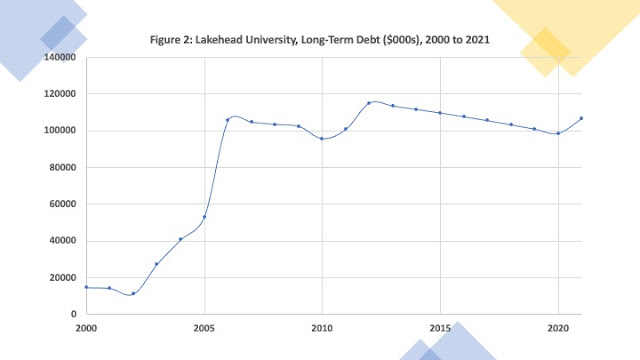

Figure 2 plots the university’s long-term debt, and it declined slightly in 2022 going from $106.575 million in 2021 to $103.655 million. Figure 3 plots the main revenue sources – general government grants and student fees - in longer-term detail. Total student fee revenue has been approximately stable since 2019 ranging from $84.460 million to $86.962 million. This is despite the fact that tuition fees for domestic students were cut 10 percent by the provincial government and then frozen during that same period. Like many other universities, Lakehead is now more reliant on international students whose tuition is not subject to the same restrictions.

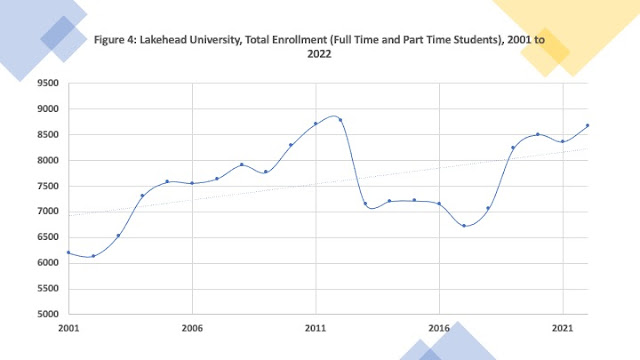

General government operating grants in absolute terms have also been stable for quite some time but in real terms (after inflation) they have declined. As a share of total revenues, student fees have steadily increased over time while government general grant revenue has declined as a share of revenue. Student fees now account for nearly 50 percent of Lakehead’s total revenue with general government grant funding now at about one-third. This makes Lakehead much more sensitive to enrollment fluctuations than it would have been two decades ago when students fees accounted for about 30 percent of its total revenues.

Fortunately, enrollment has held up (See figure 4). Total headcount enrollment (number of full time and part time students) has grown nearly 30 percent since 2017. In 2022 the total headcount (as of November 2022) grew nearly 1 percent. While the university’s total headcount has seen ebbs and flows, the overall trend since 2000 has been upwards.

So, there you have the update. Looking forward to the 2022-23 Financial Statement release!